ASM in the stock market stands for Additional Surveillance Measure. It is a regulatory mechanism used by the Securities and Exchange Board of India (SEBI) and Indian stock exchanges like the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) to monitor and control volatility in specific stocks. The primary objective is to protect investors from high-risk securities that may exhibit sudden and excessive price movements due to speculative trading, rumours, or other factors.

Meaning of ASM:

Surveillance: ASM is part of the market surveillance mechanism to ensure that stocks do not experience undue volatility that could harm investors, particularly retail investors.

Risk Mitigation:Stocks placed under ASM are considered to pose a higher risk to investors due to their volatility or trading patterns. The measures applied aim to mitigate this risk by curbing speculative trading.

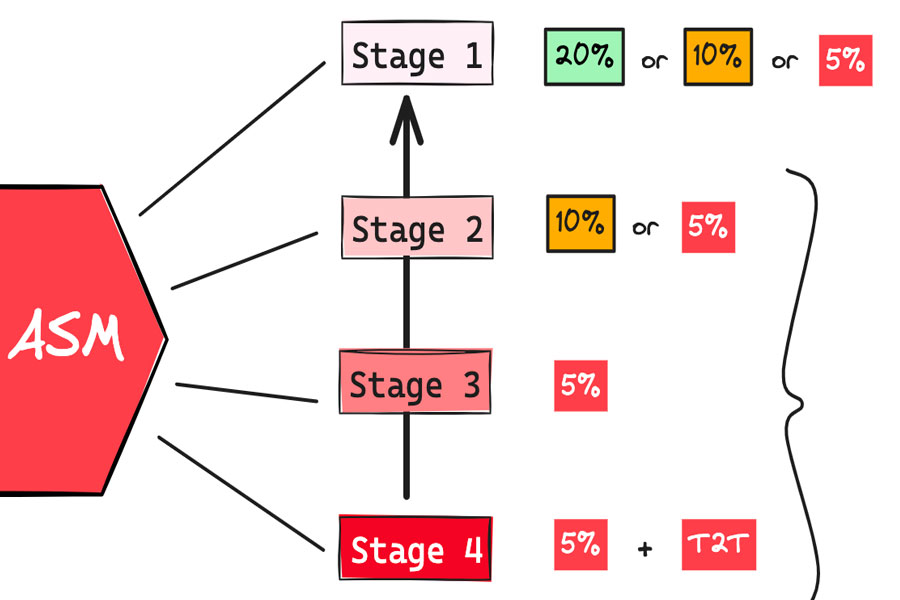

States of ASM with Examples:

ASM is implemented in various stages or levels, each with increasing severity depending on the level of risk identified in the stock. Here’s a breakdown of these stages with examples:

1. Stage 1 – Initial ASM Inclusion:

Criteria: Stocks may be placed under ASM if they exhibit unusual price movement, high volatility, or significant changes in trading volumes without any apparent fundamental reason.

Measures:

Increased margin requirements (e.g., requiring traders to deposit 50% or more of the trade value). Tighter price bands (e.g., a 5% daily price band).

Example:

Suppose a stock like XYZ Ltd. experiences a sudden 30% increase in its price over a week without any major news or corporate announcement. The stock may be placed under ASM Stage 1, with a requirement for traders to maintain a higher margin and a daily price movement limit set to 5%.

2. Stage 2 – Enhanced Surveillance:

Criteria: If a stock continues to show signs of risk despite Stage 1 measures, it may be moved to Stage 2.

Measures:

Further increase in margin requirements (e.g., 100% margin).

Stricter trading restrictions, such as no intraday trading allowed.

Example:

If XYZ Ltd. continues to rise by 20% after being placed in Stage 1, it may be moved to Stage 2, requiring 100% margin for trading, and banning intraday trading to curb speculation.

3. Stage 3 – Trade-for-Trade Segment:

Criteria: Stocks may be moved to this stage if they continue to exhibit high risk, even after Stage 2 measures.

Measures:

All transactions must result in delivery; no intraday trading is permitted.

Further margin increases.

Example:

XYZ Ltd. is now required to be traded only for delivery, meaning you can only buy the stock if you intend to hold it overnight. No intraday trades (buying and selling on the same day) are allowed.

4. Stage 4 and Beyond – Long-term Surveillance:

Criteria: This stage applies to stocks that remain under surveillance for an extended period due to continued risk.

Measures:

Continuation of all previous measures with the possibility of further restrictions.

Example: XYZ Ltd. has been under ASM for several months, showing no signs of reduced volatility. It remains in the long-term ASM framework with all previous restrictions intact.

Example of ASM Implementation:

Vakrangee Ltd.: Vakrangee, a mid-cap stock, was placed under ASM due to its significant price volatility and volume spikes without any apparent fundamental changes in the company’s business. The stock was initially placed under Stage 1, with increased margin requirements and reduced price bands. As the volatility persisted, it was moved to higher stages, restricting intraday trading and eventually requiring trade-for-trade settlement.

PC Jeweller: This stock was placed under ASM after its prices showed sharp fluctuations within a short period. Initially placed under Stage 1, the measures gradually intensified as volatility continued.

Summary:

ASM is a tool used to monitor and control volatility in specific stocks, ensuring investor protection. Stocks are placed under ASM in stages, each with increasing severity, depending on the stock’s risk profile. The ultimate goal is to curb speculative trading and protect investors from potential losses due to unjustified price movements.